CRE Forecasts For 2022

Despite the ongoing uncertainties of Covid-19, positive signs for commercial real estate can be expected in 2022, according to a round-up of sources.

Survey says…

Deloitte’s annual forecast report for the CRE sector is out, and generally reflects a high degree of buoyancy.

“Eighty percent of respondents [to their survey] expect their institution’s revenues in 2022 to be slightly or significantly better than 2021 levels,” writes the report’s authors.

…And so does the data

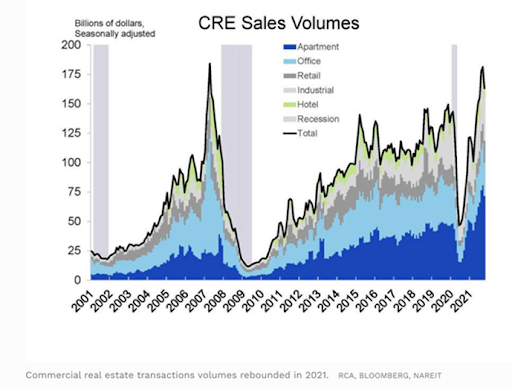

Meanwhile, Forbes real estate contributor and economic analyst Calvin Schnure has made predictions for 2022: “Property transactions will rise further in 2022 as the economic recovery gains momentum, and CRE prices will maintain growth in the mid-single digits. REIT mergers and acquisitions could top 2021 as well,” writes Schnure.

How does he come to this conclusion? It’s a matter of looking at the bigger (data) picture trends, he says – plotting this graph from RCA, Bloomberg and NAREIT data.

In December 2021, investment and commercial analysis publication The Motley Fool issued a “rare ‘all in’ buy alert” for CRE, offering three key points:

· “Industrial and multifamily sectors look the most promising in the new year.”

· “Retail and office CRE should have its good performers but see more headwinds.”

· “REITs remain a promising avenue for overall returns.”

To read the full analysis by author Marc Rappaport, click here.

Though a prediction isn’t a guarantee, we think these bold analysts make a great case for optimism and a solid-looking year ahead for commercial property and investing.